New Incoterms 2020 were released by the ICC ( International Chamber of Commerce) and will take effect on January 1, 2020. The ICC first published the Incoterms in 1936, and since then, there have been numerous revisions to account for developments in the international trade sector.

It’s crucial that everyone participating in international trade fully understands the implications of the adjustments for supply chains worldwide. There would be no global trade without Incoterms. Although Incoterms 2010 and Incoterms 2020 may appear complex, all parties involved in a transaction must thoroughly understand their roles and responsibilities across the supply chain.

Incoterms what are they?

To put it another way, Incoterms are the terms of the agreed-upon sale between a buyer and a seller in an international transaction. All international governments and courts recognize these rules as legitimate. Since Incoterms define each party’s responsibilities, costs, and risks in an international transaction, familiarity with them is crucial.

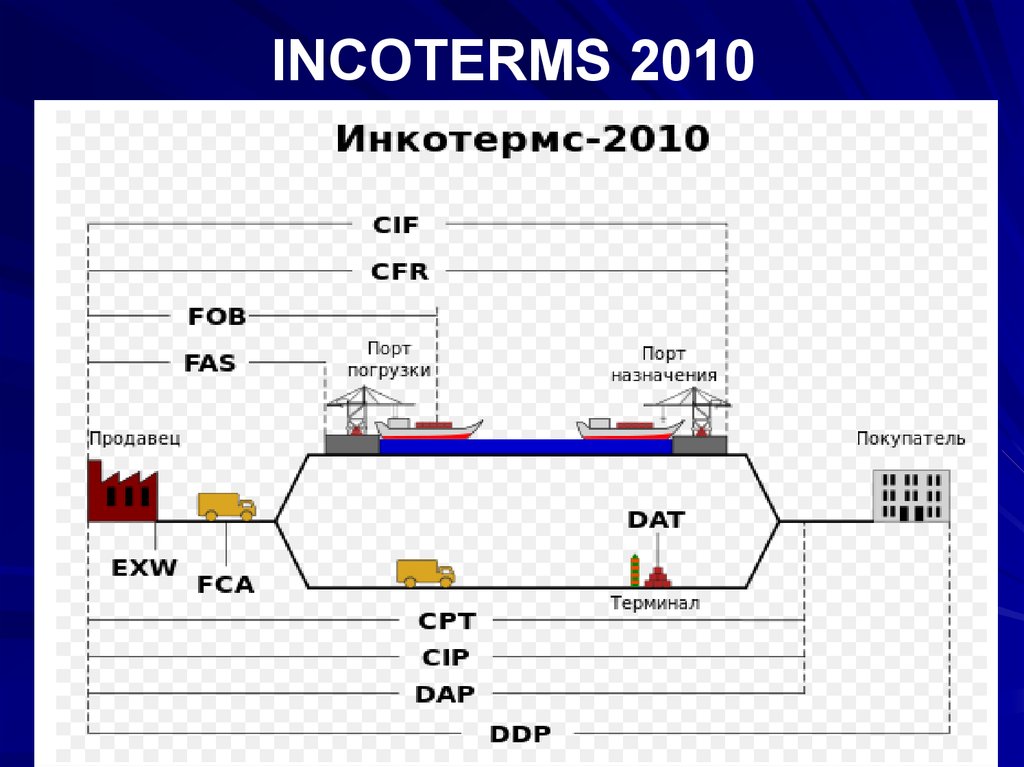

When the Incoterm indicates that the buyer is responsible for the seller’s expenses, the vendor has passed all risk and responsibility onto the buyer. For some, “transportation” can mean using any available options, including forms of land, sea, and air transport (CPT, DAP, FCA, CIP, DPU (replaces DAT), and DDP). Listed below are the meanings of FAS, FOB, CFR, and CIF, all of which apply to shipments made via sea or inland waterway conveyance.

The importance of Incoterms in cross-border transactions

International Commercial Terms (Incoterms) are used in international trade. The ICC (International Chamber of Commerce) published these guidelines to govern issues of International Commercial Law.

Most common commercial words used in contracts for purchasing goods are defined and interpreted by the Incoterms regulations established by the International Chamber of Commerce (ICC).

International transactions will be handled by the agreed-upon Incoterm, which will establish the party at law that must bear the expenses and risks associated with the transaction. All shipping documentation will include an explicit statement of Incoterms.

Seven of the Incoterms 2020 Terms cover almost every modes of transportation and are summarized below.

EXW (Ex Works/ Ex Warehouse)

Goods are considered “ex works” when made available to the customer at the seller’s premises or a specified location (i.e., warehouse, factory, works, etc.).

The vendor does not have to load the products on any pickup vehicle. It is also not required to obtain export approval if and where needed.

FCA, or Free Carrier

Upon the buyer’s request, the seller will deliver the products to the buyer’s designated carrier or another designated individual at the seller’s location.

Because the risk moves to the purchaser at the point of delivery, the parties should be as specific as possible about where the delivery will take place inside the designated place of shipment.

FAS or Free Alongside Ship

The seller delivers when the products are deposited along the vessels (e.g., on a dock or a barge) specified by the purchaser at the named shipping port.

When the merchandise is ashore, the ship takes on the risk of damage or loss to them. After that point, all fees are the responsibility of the buyer.

FOB or Free On Board

At the designated shipping port, the seller either loads the items onto the vessel designated by the buyer or arranges to have them loaded onto the vessel.

Once products are loaded into the vessel, responsibility for their safekeeping and protection is transferred to the shipper. The customer bears all charges from that point onwards.

CFR or Cost and Freight

Either the seller physically loads the items onto the ship, or the seller pays for the products to be loaded onto the ship. When an item is loaded onto a ship, responsibility for its safekeeping and protection from loss or damage is transferred from the shipper to the buyer.

To get the items to the agreed-upon port, the seller is responsible for arranging and paying for all transportation fees and freight.

CIF or Cost Insurance Freight

The seller either brings the products onto the ship or pays for them to be brought aboard. When items are loaded onto a ship, the buyer also passes responsibility for their safety and security.

To get the items to the agreed-upon port, the seller is responsible for arranging and paying for all transportation fees and freight. In addition, the seller arranges for insurance to protect the customer if the items are lost or damaged in transit.

Note that under CIF, the seller is only obligated to have minimal cover insurance, which the buyer should be aware of. Any additional insurance coverage must come from the seller’s express agreement or the buyer’s independent arrangement.

CPT stands for Carrying Paid To

The seller makes the goods available for pick up by the carrier or the seller’s designated third party at the designated delivery location.

Seller shall arrange for and pay for all transportation costs incurred in delivering the products to the Delivery Location.

CIP or Carriage and Insurance Paid To

The seller is responsible for the same things as CPT, plus they’ve agreed to insure the items against the buyer’s risk of loss or damage during transport.

The buyer needs to know that the CIP only mandates the seller to get the bare minimum in insurance coverage. Any additional insurance coverage must come from the seller’s express agreement or the buyer’s independent arrangement.

DAP or Delivered At Place

When the items are loaded into the arriving mode of conveyance and made available for offloading at the agreed-upon location, the vendor has met their responsibility. The seller is responsible for ensuring the safe delivery of the items to the agreed-upon location.

DPU (Delivery at Place Unloaded (replacing Incoterm 2010 DAT))

Incoterm DAT has been replaced by DPU (Delivered At Terminal). The seller has fulfilled their obligation to transport when the products have been unloaded and made available to the buyer at the agreed-upon location.

The seller is responsible for all costs and dangers associated with transporting and unloading the products at the agreed-upon location.

Delivered Duty Paid

When the items are loaded onto an arriving mode of transportation and are ready for offloading at the agreed-upon destination, the seller has fulfilled their obligation to deliver.

The seller is solely responsible for paying for and ensuring delivery of the items. They are responsible for clearing the goods with both export and import, bearing any necessary duties, and completing all customs paperwork.

How do a purchaser and a seller settle on a specific Incoterm?

Unless otherwise specified by the buyer, most sellers will use whatever Incoterms they see appropriate for themselves and their clients. Buyers and sellers can negotiate the best Incoterms for their transaction by discussing each option’s pros and cons and reaching a mutual agreement.

Incoterms must be incorporated in the purchase contract, invoices, or sales contract for them to be legally binding. Buyers and sellers should not rely on oral communication to establish the duty of each party when exporting products internationally; instead, they should have a written contract outlining the parameters of their agreement.

Selecting an Incoterm does not require any unique paperwork or form; instead, the term should be included alongside the product cost and described as the accepted Incoterm.

During the ordering process, Incoterms may be modified. An Incoterm may be changed, for instance, if a consignment was initially scheduled to travel by sea but must be sent by air. Some expressions cannot be used while booking an airplane ticket. Any modification to a purchase agreement would require notification to all parties involved.

Conclusion

You should constantly evaluate the potential effects of any updates to Incoterms® on your company. When dealing with significant problems with orders or shipments, it’s preferable to take preventative measures rather than reactive ones. Always consult with competent legal guidance before making any modifications to your business.

The Government of India implemented the Advance Authorization or Advance License Scheme, a form of tariff exemption, as part of the FTP (Foreign Trade Policy) 2015-2020. This customs duty exemption allows for the duty-free importation of raw goods and inputs used to manufacture export products.

One of the goals of this strategy is to make Indian goods and services more competitive globally. Avoiding import taxes on raw materials helps keep the overall cost of the exported goods low.

Authors Bio:

Mr. Mehul Goyal is a professional DGFT Consultant – Advance License Scheme with experience of more than 30 years and specialized in the field and is offering DGFT Consulting Services all over India. He is working with many importers and exporters